It’s graduation season y’all! With so much excitement also comes a lot of changes, and that’s one of the reasons I wanted to share my monthly budget spreadsheet for students. Whether you’re graduation from high school, college, grad school, etc., having a budget will help you at any stage of life. After winning Black Enterprise’s April 2012 Financial Fitness Contest after college, I realized that keeping a budget for any person, athlete or not, was crucial to building wealth.

Here are a few reasons why keeping a budget is so important:

A budget can reveal spending habits. I had no idea how much money I was spending when eating out, going to the movies, and buying clothes until I started to track my spending. Even recently, having a budget helped me and Kurt cut our cable package and other subscription services we didn’t need, allowing us to put more money into our savings account.

Having a budget helps you achieve long-term goals. My budget allows me to easily allocate funds into my savings account. In the past, budgeting has given me the ability to save for vacations, purchase a car, renovate my home, refresh my wardrobe, and so much more.

A budget can prepare you for emergencies. Part of you budget should include an emergency savings ‘bucket’ or a rainy day fund. I’ve had so many instances where my car needed a repair, I had a medical bill pop up, or I needed to pay more than expected on my taxes. Having the cash on hand, thanks to the savings I allocated in my budget helped me pay those obligations without hassle.

A budget can prevent you from overspending. If you are disciplined and stick to your budget, it will help you from overspending. I programed my brain not to pay for items with my credit card unless I have the cash on hand to pay for 90%-100% of the balance right away. Budgets can help you stay on track with your goals and can help prevent or get you out of debt.

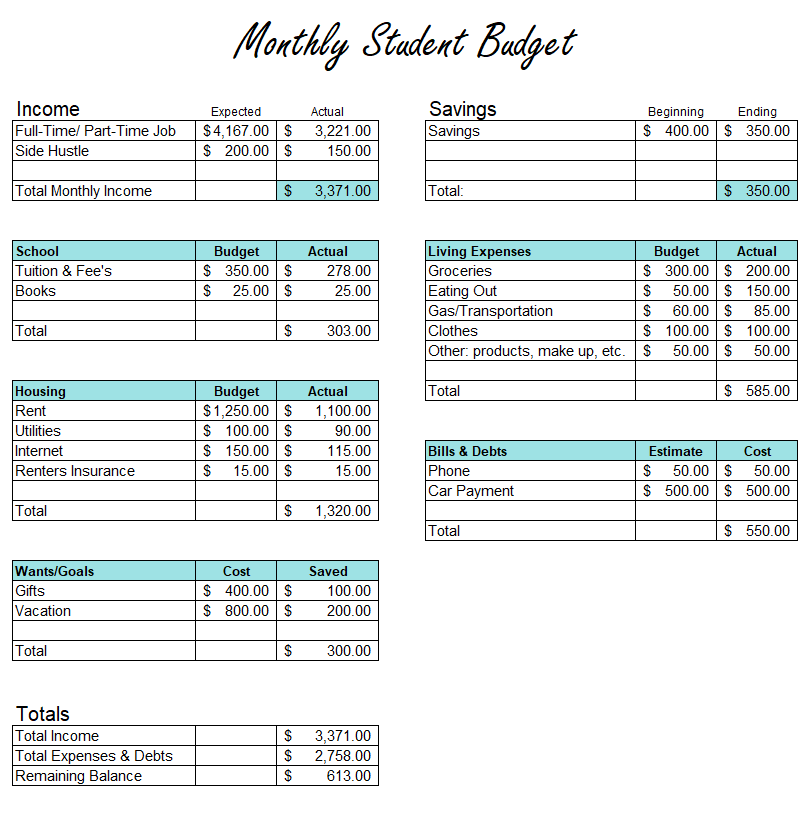

Here is the link to my free monthly student budget spreadsheet:

Monthly Student Budget Spreadsheet

Also, a few things to note:

- Download the link and open up the excel file.

- Note that there are two tabs: tab #1 titled ‘Student Budget Tracker’ and tab #2 titled ‘Example’. The second tab gives you an example of how the spreadsheet can be filled out, while the first tab is a blank slate for you to use.

- The ‘totals’ boxes are populated with formulas that will calculate your earnings, savings and balances. If you need to make changes, just know it can affect the rest of the spreadsheet.